It’s never too early to save for retirement. And, actually, it is critical to start saving early before retirement planning requires setting larger amounts of money aside over a shorter period of time.

It’s never too early to save for retirement. And, actually, it is critical to start saving early before retirement planning requires setting larger amounts of money aside over a shorter period of time.

Contributing to a retirement account allows you to put money away before taxes are taken out—which also decreases your taxable income. Here’s how to take full advantage of 401(k) and individual retirement accounts (IRAs) in 2016.

Max out your 401(k). It’s a lofty goal, but workers who max out their employer-offered 401(k) plans will also save, at minimum, $4,500 on their federal income tax bills, depending on the tax bracket percentage they fall under. Workers can contribute up to $18,000 in 2016. People aged 50 or older can contribute an additional $6,000 in catch-up contributions, for a total of $24,000. To completely max out this account, you will need to save $1,500 a month (that’s $750 per semimonthly paycheck). If you are 50 or older, you’ll need to save $2,000 a month.

If these contributions are made via (pre-tax) payroll deduction, the tax benefits are immediate because less money is withheld for income taxes.

In retirement, 401(k) account withdrawals are taxed as ordinary income. And if you drop into a lower tax bracket in retirement, you will pay that lower rate on the distributions.

Meet your employer’s match. Maxing out your 401(k) is a pretty ambitious goal, and not everybody can do it. But if your employer offers matching funds, you should at least try to contribute enough to take full advantage of that “free” money. Let’s say your employer offers a 401(k) match up to 6 percent of pay. If your annual salary is $50,000, this means contributing $200 a month, or $100 per semimonthly paycheck—which is much more manageable than $1,500 a month. Plus, your employer will contribute an additional $200 a month.

An easy way to gradually build up to your employer’s full match is to increase your contribution percentage with each raise or pay increase. This way, you won’t feel the difference in your paycheck.

Diversify: Open an IRA. In 2016, retirement savers can defer income tax on up to $5,500 in IRA contributions. People over age 50 are allowed to put in an extra $1,000 in catch-up contributions, for a total of $6,500. Maxing out an IRA requires saving $458 each month ($542 if you’re 50 or older).

It’s important to note that taxpayers who have a 401(k) account at work and a modified adjusted gross income of more than $71,000 ($118,000 for joint filers) in 2016 won’t be able to claim the tax deduction for their IRA contributions. You also won’t receive the full tax deduction if your income is between $61,000 and $71,000 ($98,000 to $118,000 for joint filers). If you are married to someone with a retirement account, the tax deduction for your IRA contributions is phased out (partial deduction) for couples earning between $184,000 and $194,000. There is no deduction for couples earning more than $194,000. More information on IRS deduction limits can be found here.

Consider a Roth IRA. You won’t get a tax deduction for Roth IRA contributions, but withdrawals are tax-free if you are at least 59 1/2 and your account is at least five years old. The contribution limits are the same as traditional IRAs. Roth IRA eligibility phases out for taxpayers whose adjusted gross income is between $117,000 and $132,000 ($184,000 to $194,000 for married couples).

Claim the saver’s tax credit. If you save in a retirement account and your adjusted gross income in 2016 is less than $30,750 for individuals, $46,125 for heads of household and $61,500 for married couples, you may be eligible for the saver’s credit. (Income limits are adjusted annually.) Contributions of up to $2,000 ($4,000 for joint filers) could earn you a tax credit worth 10 to 50 percent of your retirement account deposit. The less income you have, the higher the percentage.

Automate your savings. As they say, out of sight is out of mind. If you have a portion of your pay direct-deposited into a separate retirement savings account, you are less likely to accidentally spend cash earmarked for your nest egg.

Consider hiring a pro. Retirement planning can be stressful and confusing. Getting an objective point of view on how to meet your goals may be well worth the money. To be sure you are also maximizing your retirement plans’ tax benefits, contact us. www.ramsaycpa.com

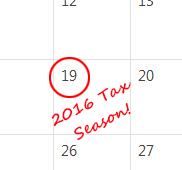

week, the Internal Revenue Service announced today that the nation’s tax season will begin as scheduled on Tuesday, Jan. 19, 2016.

week, the Internal Revenue Service announced today that the nation’s tax season will begin as scheduled on Tuesday, Jan. 19, 2016.